TL;DR

The Simple Moving Average (SMA) is a straightforward tool that smooths out price fluctuations to reveal underlying trends, making it a great starting point for traders and algo enthusiasts to spot buy or sell signals through crossovers.

Introduction

Ever stared at a choppy stock or forex chart and wondered how to cut through the noise? Here is the Simple Moving Average (SMA), a basic yet powerful indicator that averages prices over a set period to highlight trends. Whether you’re a beginner dipping into trading algorithms or just curious about market analysis, understanding SMA can help you make sense of price movements and even build simple strategies. In this post, we’ll break it down with examples, explore its strengths and pitfalls, and tie in real-world insights to show why it’s a solid foundation for more advanced trading ideas.

What Exactly Is a Simple Moving Average?

At its core, the Simple Moving Average calculates the average price of an asset over a specific number of periods, like days or hours, to smooth out short-term volatility and reveal the bigger picture. It’s called “moving” because it updates with each new data point, dropping the oldest one to stay current.

For instance, a 5-period SMA adds up the last five closing prices and divides by five. As explained in this Investopedia guide on SMA, it’s one of the most accessible technical indicators, often used in everything from stock trading to forex.

How to Calculate SMA: A Step-by-Step Breakdown

Calculating SMA is refreshingly simple, no advanced math required. The formula is straightforward: sum the prices over your chosen periods and divide by the number of periods.

Take a real-world example with EUR/USD forex prices:

- Last five closing prices: 1.0850, 1.0852, 1.0848, 1.0855, 1.0853

- SMA = (1.0850 + 1.0852 + 1.0848 + 1.0855 + 1.0853) / 5 = 1.0852

When a new price comes in, say 1.0860, drop the oldest (1.0850) and recalculate: now it’s 1.0854. This rolling update helps track trends without getting bogged down by every tiny fluctuation. For a hands-on demo, check out my Github Jupyter Notebook on SMA trading challenges, which walks through implementing SMA in Python for algorithmic trading.

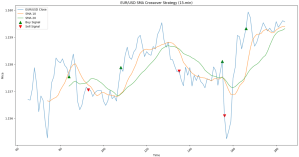

Why Use Two SMAs? Unlocking Crossover Signals

One SMA is useful, but pairing a fast SMA (like 5-period) with a slow SMA (like 20-period) amps up its power. The fast one reacts quickly to price shifts, while the slow one provides a smoother view of long-term trends.

A key strategy? Watch for crossovers. When the fast SMA crosses above the slow one, it signals upward momentum a potential buy. Crossing below suggests a sell. Visually, imagine choppy prices as a wavy line, the 5-SMA as a mildly smoothed curve, and the 20-SMA as an even gentler wave. That crossover point often marks a trend shift, helping traders avoid reacting to every minor wiggle. It’s especially handy in trending markets, like forex pairs during strong economic moves.

When SMA Shines and When It Falls Short

SMA excels in trending environments, catching big moves with proper risk tools like stop-losses. Combine it across timeframes daily for trends, hourly for entries and add filters like volume or volatility to cut false signals.

That said, it flops in sideways markets, leading to whipsaws (false signals that reverse quickly). It also lags, meaning you might miss part of the move. In efficient markets, its simplicity means everyone uses it, diluting any edge. To boost profitability, factor in transaction costs, use position sizing like the Kelly Criterion, and pick trending assets like commodities. For learning, it’s your “Hello World” in algo trading, teaching execution and analysis before diving into mean reversion or volatility filters.

Disclaimer: This is not financial advice. Trading involves risks, and past performance doesn’t guarantee future results. Always consult a professional before applying any strategies.

Key Takeaways

- Master the Basics: SMA smooths price data for trend spotting; calculate it by averaging prices over periods and updating as new data arrives.

- Leverage Crossovers: Use fast and slow SMAs together for buy/sell signals, ideal in trending markets but watch for lags and whipsaws.

- Enhance with Filters: Add risk management, timeframe combos, and volatility checks to improve odds and reduce false signals.

- Start Simple, Scale Up: Begin with SMA for algo basics, then explore advanced tweaks like mean reversion for better profitability.

- Mind the Realities: It works best with low costs and trending assets, but always prioritize education over quick wins.

Conclusion

The Simple Moving Average might be basic, but its ability to distill trends from noise makes it an essential tool for any trader’s toolkit. By starting here, you’ll build a strong foundation for more sophisticated strategies. Ready to experiment? Try coding your own SMA in Python or share your crossover experiences in the comments let’s keep the conversation going!

📚 Further Reading & Related Topics

If you’re exploring Simple Moving Average, these related articles will provide deeper insights:

• Basic Concepts in Algorithmic Trading – This article covers foundational ideas in algorithmic trading, where simple moving averages serve as a core technical indicator for analyzing trends and making beginner-friendly decisions.

• Demystifying Algorithmic Trading Applications and Use Cases – It explores practical applications of algorithmic trading, complementing the understanding of simple moving averages by showing how they integrate into automated strategies for market analysis.

• Backtesting and Optimisation: The Path to Superior Trading Performance – This post discusses backtesting trading strategies, which often incorporate simple moving averages to evaluate performance and optimize beginner-level approaches in financial markets.

Leave a comment